Welcome to Part two of our Home buyer's Cheat Sheet: Checking out Government Programs and Preparing to Meet with your Mortgage Broker

Some Government Home Buyer Incentives

For those of you who have money saved up in their RRSP for retirement, consider taking advantage of the

THE FIRST-TIME HOME BUYER INCENTIVE helps qualified first-time homebuyers reduce their monthly mortgage payments without adding to their financial burdens.

The First-Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada, which offers:

• 5% or 10% for a first-time buyer’s purchase of a newly constructed home

• 5% for a first-time buyer’s purchase of a resale (existing) home

• 5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

The shared equity component of the incentive means that the government shares in both the upside and downside of the property value, up to a maximum gain or loss equal to 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment. (If you sell you home and lose money the government takes a loss too, also if you sell before paying back the government and make money, so does the government)

The homebuyer will have to repay the Incentive based on the market value of the home at the time of repayment equal to the percentage (for example, 5% or 10%) of the original home value used to determine the Incentive, up to a maximum repayment amount equal to:

(i) where the home’s value has appreciated, the Incentive plus a maximum gain of 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment; or

(ii) where the home’s value has depreciated, the Incentive minus a maximum loss of 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment.

The homebuyer must repay the incentive after 25 years, or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full any time before, without a pre-payment penalty.

THE HOME BUYERS TAX CREDIT

The Home Buyers’ Amount offers a $5,000 non-refundable income tax credit amount on a qualifying home acquired during the year. For an eligible individual, the credit will provide up to $750 in federal tax relief.

From the Government of Canada website:

“ Line 31270 – Home buyers' amount

Note: Line 31270 was line 369 before tax year 2019.

You can claim up to $5,000 for the purchase of a qualifying home in the year if both of the following apply:

• you (or your spouse or common-law partner) acquired a qualifying home

• you did not live in another home owned by you (or your spouse or common-law partner) in the year of acquisition or in any of the four preceding years (first-time home buyer)”

ASK YOUR FAMILY OR FRIENDS FOR A LOAN

Last but not the least, if all else fails, you can always ask your friends or family members for a short term loan.

This way, you won’t have to worry about any of the things we talked about above -except budgeting, it’s always good to budget.in this post and the last.

You can keep your valuables, avoid getting a second-job, keep your emergency fund intact and just get a lump sum loan from someone close to you.

And while there are many pros to this option, there are some obvious downsides to it as well.

Business arrangements amongst people you care about is always a risk – family feuds, damaged friendships, awkward relationships, all out family brawls (wait what!?)

If things go south, you have to be prepared for those consequences.

With a simple short-term loan though, there shouldn’t be much issue – pay the money back and move on.

But where things could go wrong is if you run into a money shortage once you move into your new house and you’re unable to make the repayments.

One suggestion is making a formal, written agreement with the lender with the repayment terms laid out in a simple manner.

Money should be repaid by this date, in these increments, with this much interest, or whatever you guys decide on.

By having an agreement in place like this, you’ll avoid any awkwardness or tension during the time-frame where you are making your repayments.

PREAPPROVALS AND MORTGAGES

You will need to get preapproved for a mortgage. It just makes sense.

You can start the process before you have your entire down payment together, because being aware of your actual standing/preparedness can surprise you!

WHAT YOUR MORTGAGE SPECIALIST WILL NEED

A mortgage professional will look at your credit rating. Verify your employment and your ability to pay your mortgage. They will ask about any debt or loans to evaluate your debt to income ratio.

You may be asked for proof of your income in the form of letter from an employer, pay stubs, income tax statements, and bank statements. So if you are prepared by finding your paperwork, and statements it helps.

A mortgage broker does not give financial advice, however then can point out to you ways to improve your credit score for instance.

Preapproval is required by some real estate agents, and it definitely gives you buying and negotiating power. If you are prepared to begin shopping a preapproval can lock in your interest rate for 120 days.

It is definitely harder for first time home buyers to get into the market, and of course there other costs to budget for. However, the single biggest source of personal wealth is in real estate. It’s too important to leave to chance.

This is also why we feel so strongly about our careers as REALTORS® and helping people with home ownership. It’s emotional, the word “home” means so much to people. We work hard to help people who have done the work, the saving, the shaving of costs, and the things they needed to so to get their financial house in order. We know what it means.

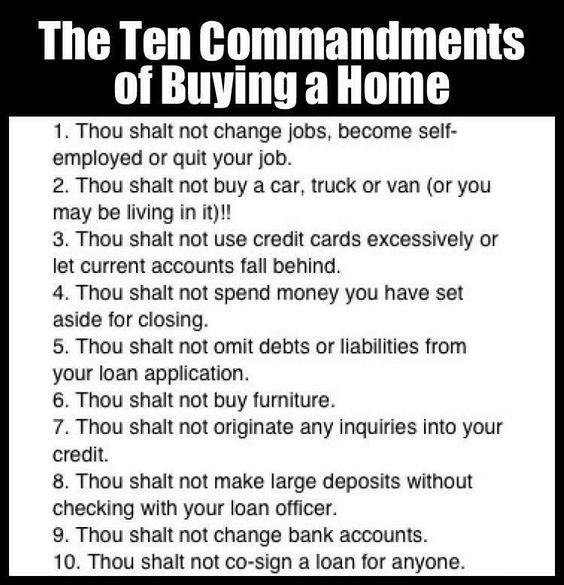

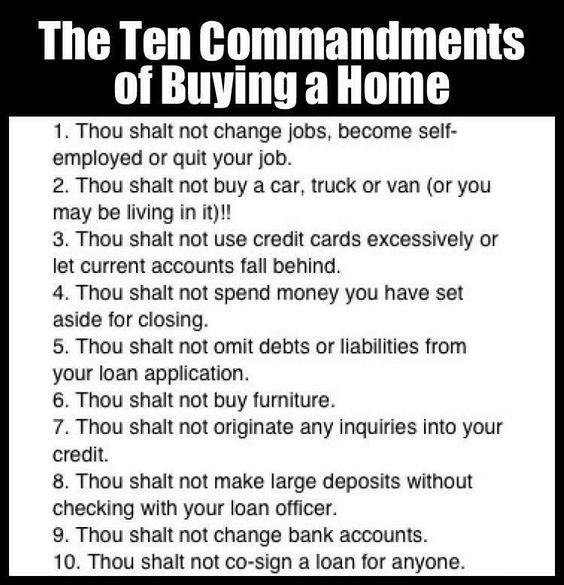

We leave you with the 10 commandments of Buying a Home:

Information taken from the Government of Canada Website & CMHC

For those of you who have money saved up in their RRSP for retirement, consider taking advantage of the

RRSP HOME BUYERS’ PLAN.

Put simply, the Canadian Government allows Canadians to withdraw up to $35,000 (as of 2020) from their RRSP in order to purchase their first house.

Now you might be wondering, what’s the big deal with this?

Well typically, any RRSP withdrawals you make before retirement are subject to withholding and income taxes. So the amount you actually get from your RRSP withdrawal is usually much less than the amount you actually withdraw.

BUT not with the RRSP Home Buyers’ Plan, as long as your withdrawal is put towards buying or building a home, you can enjoy a tax-free withdrawal up to $35,000. (Each, if you are a couple and have that in contributions)

Not bad, hey?

And while this program by the Canadian government is very beneficial to some first time home buyers, there are some disadvantages of doing this.

The most notable one being that you must pay back your withdrawal to your RRSP within 15 years, and the repayment process is a little strict.

Put simply, the Canadian Government allows Canadians to withdraw up to $35,000 (as of 2020) from their RRSP in order to purchase their first house.

Now you might be wondering, what’s the big deal with this?

Well typically, any RRSP withdrawals you make before retirement are subject to withholding and income taxes. So the amount you actually get from your RRSP withdrawal is usually much less than the amount you actually withdraw.

BUT not with the RRSP Home Buyers’ Plan, as long as your withdrawal is put towards buying or building a home, you can enjoy a tax-free withdrawal up to $35,000. (Each, if you are a couple and have that in contributions)

Not bad, hey?

And while this program by the Canadian government is very beneficial to some first time home buyers, there are some disadvantages of doing this.

The most notable one being that you must pay back your withdrawal to your RRSP within 15 years, and the repayment process is a little strict.

THE FIRST-TIME HOME BUYER INCENTIVE helps qualified first-time homebuyers reduce their monthly mortgage payments without adding to their financial burdens.

The First-Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada, which offers:

• 5% or 10% for a first-time buyer’s purchase of a newly constructed home

• 5% for a first-time buyer’s purchase of a resale (existing) home

• 5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

The shared equity component of the incentive means that the government shares in both the upside and downside of the property value, up to a maximum gain or loss equal to 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment. (If you sell you home and lose money the government takes a loss too, also if you sell before paying back the government and make money, so does the government)

The homebuyer will have to repay the Incentive based on the market value of the home at the time of repayment equal to the percentage (for example, 5% or 10%) of the original home value used to determine the Incentive, up to a maximum repayment amount equal to:

(i) where the home’s value has appreciated, the Incentive plus a maximum gain of 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment; or

(ii) where the home’s value has depreciated, the Incentive minus a maximum loss of 8% per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment.

The homebuyer must repay the incentive after 25 years, or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full any time before, without a pre-payment penalty.

THE HOME BUYERS TAX CREDIT

The Home Buyers’ Amount offers a $5,000 non-refundable income tax credit amount on a qualifying home acquired during the year. For an eligible individual, the credit will provide up to $750 in federal tax relief.

From the Government of Canada website:

“ Line 31270 – Home buyers' amount

Note: Line 31270 was line 369 before tax year 2019.

You can claim up to $5,000 for the purchase of a qualifying home in the year if both of the following apply:

• you (or your spouse or common-law partner) acquired a qualifying home

• you did not live in another home owned by you (or your spouse or common-law partner) in the year of acquisition or in any of the four preceding years (first-time home buyer)”

ASK YOUR FAMILY OR FRIENDS FOR A LOAN

Last but not the least, if all else fails, you can always ask your friends or family members for a short term loan.

This way, you won’t have to worry about any of the things we talked about above -except budgeting, it’s always good to budget.in this post and the last.

You can keep your valuables, avoid getting a second-job, keep your emergency fund intact and just get a lump sum loan from someone close to you.

And while there are many pros to this option, there are some obvious downsides to it as well.

Business arrangements amongst people you care about is always a risk – family feuds, damaged friendships, awkward relationships, all out family brawls (wait what!?)

If things go south, you have to be prepared for those consequences.

With a simple short-term loan though, there shouldn’t be much issue – pay the money back and move on.

But where things could go wrong is if you run into a money shortage once you move into your new house and you’re unable to make the repayments.

One suggestion is making a formal, written agreement with the lender with the repayment terms laid out in a simple manner.

Money should be repaid by this date, in these increments, with this much interest, or whatever you guys decide on.

By having an agreement in place like this, you’ll avoid any awkwardness or tension during the time-frame where you are making your repayments.

PREAPPROVALS AND MORTGAGES

You will need to get preapproved for a mortgage. It just makes sense.

You can start the process before you have your entire down payment together, because being aware of your actual standing/preparedness can surprise you!

WHAT YOUR MORTGAGE SPECIALIST WILL NEED

A mortgage professional will look at your credit rating. Verify your employment and your ability to pay your mortgage. They will ask about any debt or loans to evaluate your debt to income ratio.

You may be asked for proof of your income in the form of letter from an employer, pay stubs, income tax statements, and bank statements. So if you are prepared by finding your paperwork, and statements it helps.

A mortgage broker does not give financial advice, however then can point out to you ways to improve your credit score for instance.

Preapproval is required by some real estate agents, and it definitely gives you buying and negotiating power. If you are prepared to begin shopping a preapproval can lock in your interest rate for 120 days.

It is definitely harder for first time home buyers to get into the market, and of course there other costs to budget for. However, the single biggest source of personal wealth is in real estate. It’s too important to leave to chance.

This is also why we feel so strongly about our careers as REALTORS® and helping people with home ownership. It’s emotional, the word “home” means so much to people. We work hard to help people who have done the work, the saving, the shaving of costs, and the things they needed to so to get their financial house in order. We know what it means.

We leave you with the 10 commandments of Buying a Home:

Information taken from the Government of Canada Website & CMHC